Investing in Stocks:

Understanding

Different Stock Types

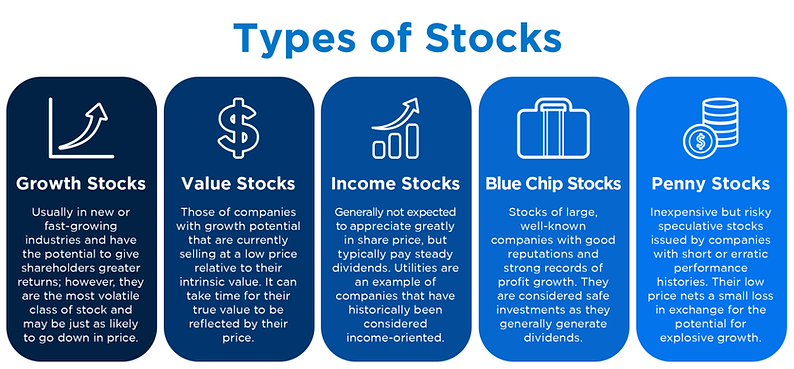

Stocks are a crucial part of any investment portfolio, and understanding the different types can help investors make more informed decisions. Stocks are not just limited to the ones publicly traded on the stock exchange; there are several categories with unique characteristics and benefits. Below, we break down various stock types to help you build a more diversified and risk-managed portfolio.

Key Takeaways

-

Different stock categories offer varying levels of risk and return potential.

-

Preferred stock provides fixed dividends but lacks voting rights.

-

Growth stocks offer high potential returns but can be volatile.

-

Defensive and blue-chip stocks provide stability in uncertain markets.

-

ESG and income stocks cater to socially conscious and income-seeking investors, respectively.

Example:

Alphabet Inc. (Google’s parent company) offers Class A common stock (GOOGL) and Class C preferred stock (GOOG).

Growth Stocks vs. Value Stocks

There are three main types of accounts that most people use:

savings accounts, checking accounts, and brokerage accounts.

Growth Stocks

These stocks belong to companies expected to grow at a faster rate than the overall market. Growth stocks typically reinvest profits rather than paying high dividends and tend to perform well in economic expansion periods.

Example:

Technology companies like Amazon (AMZN) and Tesla (TSLA) are well-known growth stocks.

Value Stocks

Value stocks are considered undervalued based on financial metrics. These companies often generate stable cash flows and tend to perform well during economic recoveries.

Example:

Financial and healthcare companies, such as JPMorgan Chase (JPM) and Johnson & Johnson (JNJ), are value stocks.

Income Stocks

Income stocks provide regular dividend payments that are typically higher than the market average. These stocks are less volatile, making them ideal for conservative investors looking for consistent returns.

Example:

Utility companies like Duke Energy (DUK) and telecommunications firms like AT&T (T) are income stocks.

Blue-chip Stocks

Blue-chip stocks are shares of well-established companies with large market capitalizations and strong earnings histories. These companies provide stability and reliability, making them an attractive choice for conservative investors.

Example:

Microsoft (MSFT), McDonald’s (MCD), and ExxonMobil (XOM) are blue-chip stocks.

Cyclical vs. Non-Cyclical Stocks

Cyclical Stocks

Cyclical stocks are heavily influenced by economic cycles and tend to perform well in times of economic expansion. These include consumer discretionary companies.

Example:

Apple Inc. (AAPL) and Nike (NKE) are cyclical stocks.

Non-Cyclical Stocks

These stocks operate in industries that remain stable regardless of economic conditions. Examples include consumer staples and healthcare companies.

Example:

Procter & Gamble (PG) and Coca-Cola (KO) are non-cyclical stocks.

Defensive Stocks

Defensive stocks provide steady returns in various market conditions and typically belong to industries offering essential goods and services.

Example:

Cardinal Health (CAH) and Verizon (VZ) are considered defensive stocks.

IPO Stocks

When a company first goes public, it offers IPO (Initial Public Offering) stock. IPO stocks can be highly volatile and speculative, often appealing to investors seeking high-risk, high-reward opportunities.

Example:

Rivian (RIVN) and Airbnb (ABNB) launched high-profile IPOs in recent years.

Penny Stocks

Penny stocks trade at very low prices (typically below $5 per share) and are considered highly speculative. They often lack liquidity and transparency, making them riskier investments.

Example:

OTC stocks or small-cap companies like those found on the OTCQB market.

Conclusion

Understanding the different types of stocks can help investors make better financial decisions and diversify their portfolios effectively. Whether you seek stability, growth, dividends, or ethical investments, knowing the distinctions between stock categories can help you align your investments with your financial goals.